Benjamin Franklin as soon as stated that there are two points specific in life: fatality and tax obligations. Though we’re commonly dealt with the latter, we avoid the former until it is too late. Planning for our own demise is something that many people never think of. We don’t wish to and that’s completely easy to understand.

Yet leaving this world without having a prepare for your loved ones and your belongings can trigger some problems. Allow’s talk about why you need a Will.

What Is a Will?

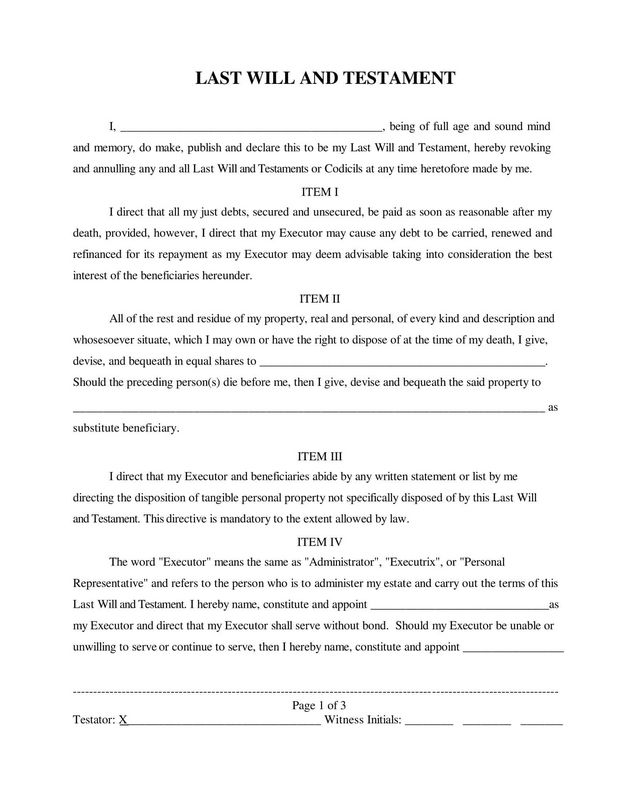

A Will is a lawful document stating your wishes upon your fatality. They usually consist of the distribution of your building, who will look after children and animals, and in some cases, what your needs are regarding your funeral arrangements. You may also include donations for companies you are passionate about, ask for unique setups for loved ones (such as the stories of husbands prepaying for Valentine’s Day blossoms years in advance), or needs concerning inheritance.

There are several ways to develop Wills, though a popular method is a Video clip Will. The lawyer works as the recorder of the video and allows you to resolve your after-life events. It offers the family members one last chance to say goodbye, hear your voice, and enjoy that you were.Read here Hawaii Last Will At our site These Wills are not an alternative to created Wills and need to be accompanied by a standard Will, in print, to be carried out.

What Occurs Without One?

In brief: Mayhem. Though you might have made your demands understood to family members, they have little lawful ability to implement them without documents. Even if your bank account is vacant, you might still have a home, a car, or perhaps a specific ceramic cat that 3 of your adult youngsters desire in their specific homes. And for those with substantial estate left? A Will is a need.

With a Will, each of your possessions is very carefully assisted to its new home. Whether it is cash, a home, an automobile, or your meals, whatever lands where it is supposed to. Without a Will, your family members are stuck divvying up your belongings like a flea market.

In addition to this, if you have considerable debt left, you may leave a large amount of rivalry to your family and enjoyed ones. A Will is the safest means to assure a simple shift for your family members when you’re gone. Better yet, they aren’t extremely challenging records and lawyers procedure hundreds of hundreds of them annually.

Executing a Will

Performing a Will just means that you’re making it lawful. Laws vary from one state to another, yet in the majority of states:

- You’ll indication it while you’re still of sound mind and body.

- Have 2 witnesses authorize it at the same time.

- Have it notarized.

That’s it.

You’re ended up. You might additionally pick to affix a self-proven affidavit to the Will. This allows the probate court to accept the Will after your passing without the witnesses present. This is specifically helpful if your witnesses are busy individuals or potentially not able to drop what they’re performing in the occasion of your unforeseen loss. Self-proven Wills are really common in large estates. These are already complicated matters and require a lot of job from the Administrator as it is. Numerous big estate proprietors make use of self-proving testimonies to make the procedure less complicated for everyone included.

Your Executor has nothing to do with implementing your Will, though the two audio really similar. But they have everything to do with the probate court.

What Is Probate?

Probate is the court-supervised procedure of both carrying out a Will and confirming it. As pointed out over, if a sworn statement is present this procedure is usually expedited. Once the court has actually established the authenticity of the Will file, your dreams will be performed. Executors utilize Wills as guides for determining what goes where, that involves any possible analysis of the Will (some families do this, others do not), and completing out your last expenses. Taxes, funeral or cremation costs, sales of items, contributions, and things like that are all part of their task.

When a Depend on Is Required

For those on the affluent end of the spectrum, a Depend on is generally essential. In situations where there isn’t a sole family member remarkably conscientious with financial issues, the usage of Trust fund documentation comes to be vital. This proactive monetary method not just adds to the longevity of your family’s riches but likewise makes certain that future generations will be well-provided for, cultivating a legacy of monetary stability.

Final Ideas

Absence of a Will can make complex the distribution of your assets, potentially triggering family members problems. Luckily, the legal process for creating a Will is straightforward and supplies assurance. If you have added questions or need assistance with estate preparation, we strongly recommend seeking advice from an experienced estate preparation attorney. Preparation for the future is an accountable and caring represent your family members’s well-being.