Articles

The main one Huge Stunning Statement extends multiple trick components of the fresh 2017 Taxation Cuts and you will Operate Work (TCJA) that have been set-to end just after 2025. It means the product quality deduction, that was nearly twofold under the TCJA, will continue to be during the those large profile, unlike reverting to pre-2017 amounts. The financing, which had been set-to expire at the end of 2025, is now permanent. As well, companies are now able to render it to specialists once half a year away from employment; previously, the minimum solution requirements is annually.

Individuals with income as high as $75,one hundred thousand ($150,one hundred thousand to own spouses submitting jointly) is also subtract an entire $6,100000 using their nonexempt income. The new deduction levels away during the highest income profile, and you can’t claim any one of it for many who earn significantly more than simply $175,100000 ($250,100 for a couple). A great deduction to have overtime shell out as high as $12,five hundred (single) and you will $twenty-five,100 (joint) is invited away from 2025 to help you 2028, susceptible to a similar income phaseouts since the deduction to possess licensed idea earnings. Employers tend to nevertheless keep back federal taxes out of tips and you can overtime through the 2025.

When really does the major gorgeous expenses, zero income tax to your overtime initiate? This is what understand

Productive to own assets listed in services after January 19, 2025, which transform repeals the new previously scheduled stage-off and you can allows enterprises to completely bills qualifying assets in the 12 months away from pick. With so many specifications packaged to your that it statement, here you will find the really impactful alter business owners and you may higher-earnings taxpayers should understand and exactly how they could shape their thought inside 2025 and you can past. Particular independent contractors and business owners might qualify, provided their business terrible receipts surpass organization deductions, losses and you may will cost you, for instance the price of products ended up selling. For starters, Public Security beneficiaries that have down revenues basically wear’t owe fees to their benefits — that’s a destiny one to attacks higher-earnings beneficiaries. In addition to, the new income tax split provides money restrictions you to skew the benefit to your down-income taxpayers.

Taxpayers which invest in QOZs receive certain taxation advantages due to their assets because the an incentive to change financial growth and you can jobs production throughout these underserved groups. Non-citizens, like those going to the All of us, can also be eligible for the new senior incentive if they meet up with the income qualifications criteria. The advantage would be provided by 2025 to help you 2028 unless of course Congress and also the Light House want to expand it subsequent.

Your Income tax Protecting Service

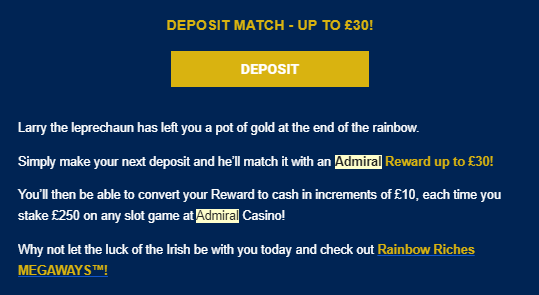

Businesses put predetermined benchmarks and rehearse a strong calculation algorithm in order to accurately size shows happy-gambler.com web sites vs bonus profits. A good added bonus structure aligns company objectives having employee passions. It efficiently address working demands – for example waste and cost control – and you will personally connections which so you can monetary benefits to possess team.

Beginning in 2022, so it interest restriction try fasten to help you 30 % out of earnings ahead of desire and fees (EBIT), leaving out the worth of decline and you can amortization in the computation and you may automatically lowering the number of interest allowable. Merely staff who are not exempt out of Reasonable Labor Conditions Operate (FLSA) overtime legislation qualify, and just the brand new 0.5 “premium” percentage of a period . 5 is eligible to the deduction and will also be accessible to one another itemizers and you may low-itemizers. Legislation brings stability to have ticket-due to companies, and you will 199A permanency results in OBBA’s specialist-progress impact, nevertheless misses an opportunity to clarify the newest taxation treatment of pass-thanks to organizations. “The brand new Internal revenue service spends ‘combined income’ to determine if a portion of Personal Protection advantages was taxed,” told me Smalls-West. “Dependent on one matter, between 0% to 85% away from benefits will be taxed.” Along with seemed inside season are the trick test duo, The fresh Bryan Brothers, and George and you may Wesley Bryan.

The bill helps to make the TCJA’s seven-group tax system permanent and you will grows rising prices changes to possess down brackets. The product quality deduction try locked in the during the a sophisticated, as well as the extended Kid Income tax Credit is forever enhanced. – The only, Larger, Gorgeous Expenses meets Chairman Trump’s promise in order to seniors and provides acceptance income tax rescue after five years of inflation robbed the senior years below President Biden.

Landlords must look into a cost Segregation Study to determine the helpful longevity of their property and, having one hundred% bonus decline, look at whether enhancements build economic experience now. The fresh tax price on the bonuses is actually 22% to possess government fees should your extra view is created while the a great independent payment of an everyday income. In case your incentive is roofed as an element of an everyday salary, then your withholding positioned to suit your normal paycheck perform apply. When you yourself have a high-allowable fitness package (HDHP) for health insurance, you’re entitled to sign up for a medical savings account (HSA) tax-totally free. To have 2025, the new sum limit for someone that have private coverage is actually $cuatro,3 hundred or more so you can $8,550 to possess loved ones coverage.

People in the us could get large taxation refunds the coming year, economic investigation finds out

The brand new taxation laws and regulations may start with your 2025 tax come back you will document next season (within the 2026).If you’re also concerned with what this means to you, don’t fret — TaxAct often walk you through all changes whether it’s time to document. Let’s comment a number of the most significant changes in the past taxation bill, you start with private taxpayers and moving forward to business owners. The new 2017 Taxation Slices and you may Work Operate (TCJA) reduced five of one’s seven individual tax mounts, like the best speed, and that fell of 39.six percent in order to 37 percent. Those rates decrease had been set to sundown after 2025, nevertheless You to definitely Big Breathtaking Costs Act, as the level is actually generally entitled, makes them permanent.

You simply can’t avoid paying taxation on the incentive altogether, but you will find court the way you use their extra to reduce your current tax implications or bundle your taxation to prevent a big costs once you know you’ll receive a bonus. This advice are common Internal revenue service-recognized and will help you continue a lot more of their view. Your boss will keep back money to cover additional fees, including Medicare and Public Protection. The newest act in addition to revamps a few of the TCJA’s provisions for the taxation away from businesses’ international income and you may terminates thousands of clean opportunity income tax bonuses. By far the most successful investors plan for taxation strategy along side complete lifecycle of its home, doing before acquisition and you may stretching right through hop out. Don’t think about this while the a fast payment—it’s a good jumpstart to the a long-name deals device.

The bill will not fully submit for the Trump’s promise to stop fees on the Social Security professionals as the reconciliation procedure lawmakers are utilising to pass through the bill does not allow it to be transform to your trust financing you to secure the program. Sodium is short for “state and you can local taxes,” and you will landlords can also be subtract the total amount paid back in your town from their federal goverment tax bill. The brand new “SALT cap” is the limitation so you can exactly how much will likely be subtracted; that is to possess homeowners’ number 1 house, maybe not leasing functions. The beauty of a keen HSA is that the contributions are pre-tax, plus the money will likely be sent out to subsequent many years or even in order to old age if not needed for scientific expenses.

You can also find a good $4,100000 taxation borrowing from the bank out of Biden’s laws and regulations for an excellent utilized EV, but you to wouldn’t qualify your for the Trump tax borrowing. Get Wiser by CNBC Create It’s the new on the internet course Ideas on how to Get your Basic Home. Professional educators will help you to weighing the price of leasing versus. to purchase, financially get ready, and you may with confidence navigate each step of the procedure—from mortgage basics to closing the offer. Sign up now and rehearse promotion code EARLYBIRD to have a basic disregard away from 30% out of $97 (+fees and you may charges) because of July 15, 2025. Our home variation create suspend the newest capitalization and you can amortization need for residential Roentgen&D costs paid or incurred immediately after December 30, 2024 and you may just before January step 1, 2030.

If you’lso are not sure the the new law affects your — let us opinion their earlier season taxation go back for free and find out overlooked offers. The new deduction to have condition and you can local fees (SALT) are improved of $ten,one hundred thousand so you can $31,100000 to have households making less than $eight hundred,000. You to definitely results in $23,750 overall write-offs, to own an excellent taxable income away from $46,250. A good 72-year-old single filer having $70,one hundred thousand inside income in the 2025 can be claim a simple deduction out of $15,750. Usually the one Big Breathtaking Expenses Operate has supersized the product quality deduction for the elderly.