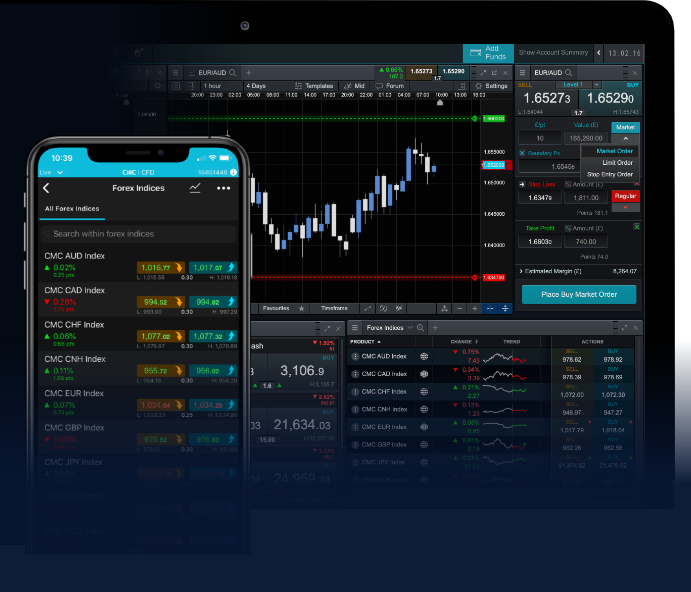

In the fast-paced world of forex trading, having the right tools can make all the difference. One of the essential elements in a trader’s toolkit is the use of indicators, which are mathematical calculations based on price, volume, or open interest of a currency pair. These indicators help traders analyze market trends, identify entry and exit points, and manage risk effectively. In this article, we will explore some of the best indicators for forex trading that can enhance your trading strategy. For more resources, you can check out best indicators for forex trading Trading Platform VN.

1. Moving Averages

Moving averages (MA) are one of the simplest yet most effective indicators used in forex trading. They smooth out price data to identify the direction of the trend. There are two types of moving averages: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA calculates the average price over a specified period, while the EMA gives greater weight to recent prices, making it more responsive to new information.

Traders often use moving averages to determine support and resistance levels, and they can act as dynamic zones where price may react. Additionally, crossovers between short-term and long-term moving averages can signal potential trend reversals or continuations.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a market. An RSI above 70 may indicate that a currency pair is overbought, suggesting a potential reversal, while an RSI below 30 may signal that it is oversold.

Traders often combine the RSI with price action analysis to strengthen their trading signals. For example, if the RSI indicates overbought conditions while the price starts to show signs of reversal, it may present a good selling opportunity.

3. Bollinger Bands

Bollinger Bands consist of a middle band (the SMA) and two outer bands that are set two standard deviations away from the middle band. This indicator helps traders comprehend volatility in the market. When the bands contract, it often signifies a period of low volatility and can indicate that a price breakout is imminent. Conversely, when the bands expand, it indicates increased volatility.

Traders can also use Bollinger Bands to identify potential trading opportunities. For example, when the price touches the lower band, it may indicate a buying opportunity, while a touch at the upper band may signal a selling opportunity. However, it’s essential to use Bollinger Bands in conjunction with other indicators to validate trading signals.

4. MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum oscillator that shows the relationship between two moving averages of a currency pair’s price. It consists of the MACD line, the signal line, and the histogram. Traders look for crossovers between the MACD and signal lines to identify potential buy and sell signals.

The histogram also illustrates the strength of the trend. When the histogram bars are above the zero line, it indicates a bullish trend, while bars below the zero line indicate a bearish trend. The MACD can be effectively combined with other indicators for more reliable trading decisions.

5. Fibonacci Retracement Levels

Fibonacci retracement levels are derived from the Fibonacci sequence and are used to identify potential reversal levels based on the belief that markets will retrace a predictable portion of a move and then continue in the original direction. Key Fibonacci levels include 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

Traders often use Fibonacci levels to identify potential support and resistance areas during a pullback. By combining this tool with other indicators, they can strengthen their trading strategy, as well as increase the likelihood of placing successful trades.

6. Stochastic Oscillator

The Stochastic Oscillator is another momentum indicator that compares a currency pair’s closing price to its price range over a specified period. It ranges between 0 and 100, with values above 80 suggesting overbought conditions and below 20 suggesting oversold conditions. The main purpose of the Stochastic Oscillator is to identify potential reversal points in the market.

Traders typically look for divergences between the oscillator and price movements, which can signal a potential reversal. The use of the Stochastic Oscillator in conjunction with other indicators, such as the RSI, can further validate trading signals.

7. Average True Range (ATR)

The Average True Range (ATR) measures market volatility by analyzing the range between the high and low of a currency pair over a specified period. A higher ATR indicates increased volatility, while a lower ATR signifies lower volatility.

Traders can use the ATR to determine optimal stop-loss placement and profit targets. For instance, during periods of increased volatility, traders might widen their stop-loss levels to avoid getting stopped out prematurely. Conversely, during lower volatility periods, they can tighten their stops to reduce potential losses.

Conclusion

Indicators play a vital role in forex trading, providing traders with valuable insights into market conditions and potential trading opportunities. While no indicator guarantees success, utilizing a combination of different indicators can enhance a trader’s ability to make informed decisions. When choosing indicators, it’s crucial to consider your trading style and strategy. Practice using these indicators on demo accounts before implementing them in live trading to gain confidence and refine your approach.

Always remember that successful trading involves continuous learning and adaptation to changing market conditions. By incorporating the best indicators for forex trading into your strategy, you can increase your chances of achieving consistent profits over time.